2020: Net Worth & Portfolio Update

How was your 2020?

Well, we hope it was good for you :-)

It's been a year of changes and amidst all the ups and downs, we are glad that we achieved certain milestones together as a couple that will eventually lead us to our end-goal which is long term financial stability and a constant flow of passive income.

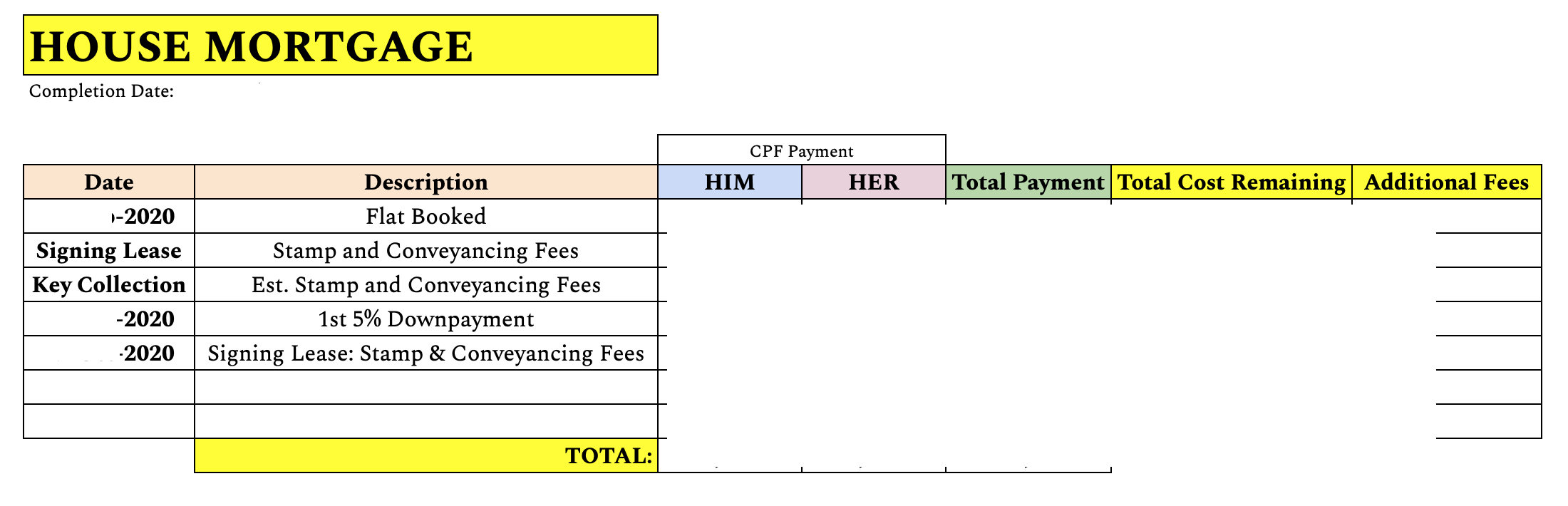

First off, one of the biggest milestone of the year would be selecting our BTO flat and paying the first 5% downpayment. And now the waiting game begins. We have created a tab in our finances spreadsheet to track our costs and financing for our home.

Apart from that, we have started a joint account consisting of our reno fund. We have also set up individual reno funds within our own respective bank accounts. So in all, our reno fund is spilt up into 3 bank accounts and this is tracked by a rough gauge of our Projections tab in our finances spreadsheet (Thanks Seedly!!). This fund is mainly used for reno, subsequently wedding and kids. TBH, this tab is slightly redundant as we do not refer to it, really just as its name suggests - PROJECTION.

I think that's about it. It is quite a lengthy post but I hope this will be of good knowledge for couples who need to tidy up their finances. We are not professionals and I believe there are many ways out there to track your finances as a couple as long as both of you are on the same page, everything will be smooth sailing!

Next, we have reached 300K+ for our combined net worth (including CPF, excluding property). Our next goal will be 500k by 2022. We will be 30 (he) and 27 (she) by then. Of course, the sky is the limit. Similarly, our net worth is also in our finances spreadsheet adapted from Seedly. Our figures are also plucked from our Seedly app that we use daily to track our income and expenses (no, we are not sponsored HAHA but good things must share).

**couple tip: It doesn't matter if your better half has a lower net worth compared to you. I am happy that he is not affected by it and in fact, he is striving even harder to increase his net worth.

(Side note: He excluded a significant sum of $ that is placed in an investment instrument that generates ~6% yearly.)

Lastly, our investments have increased greatly this year due to the dip in the market. We use StocksCafe to track our dividends and he also created a spreadsheet to record out investments allocation. I believe this is not up to date but I am too lazy to edit it as these figures are not done by me. As you can see we use two Robo Advisors and we DCA monthly into both. Endowus is used as our Retirement Growth Fund whereas Syfe is only used by me (♀) as a form of diversification. This spreadsheet is quite neglected and since we DCA, it is quite tedious to edit monthly so maybe it will only be updated every 6 months.

Last but not least, I am including our savings rate for our own record - approx. 75% (due to the lack of opportunities to travel, sadly.)

Time to give ourselves a pat on our back for working hard in 2020!

Let's all look forward to 2021!

Cheers :-)

Comments

Post a Comment